Technology

-

Why Pay For Bells And Whistles When Near-shoring? Just Pay For What You Need!

- August 26, 2019

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Nearshore call Centers, Opinions, Reduce labor cost, Technology

No Comments

-

It Takes A Lean Dog For The Long Chase

- October 22, 2018

- Posted by: Phillip W. Duff

- Categories: Agencies, International, Jamaica, Latest Post, Opinions, Reduce labor cost, Technology, Training

-

How do you integrate your multichannel debt collection strategies with your staffs outbound calls?

- July 19, 2018

- Posted by: Phillip W. Duff

- Categories: Agencies, Business plans, International, Jamaica, Latest Post, Technology, Training, Uncategorized

-

Are You Paying Too Much To Collect Your Money? Are you paying for stuff you don’t use?

- March 11, 2018

- Posted by: Phillip W. Duff

- Categories: Agencies, Business plans, International, Jamaica, Nearshore call Centers, Opinions, Reduce labor cost, Technology, Training

-

Come To Jamaica And Let Me Take You To A Call Centre, You’ll See The Value Immediately.

- March 11, 2018

- Posted by: Phillip W. Duff

- Categories: Agencies, Business plans, International, Jamaica, Latest Post, Nearshore call Centers, Technology, Training

-

How Do Debt Buyers Xerox, AT&T, Collection Agencies, Vistaprint, and Major Airlines Handle Their Phone Communications? Jamaican Call Centres Thats How ????????

- December 20, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Business plans, Economics, International, Jamaica, Latest Post, Nearshore call Centers, Opinions, Technology

-

How My Clients Bridge the Strategy-Execution Gap

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Latest Post, Law Firms, Opinions, Technology, Training

-

Is Your Company Really Set Up to Support Your Collection Strategies?

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Latest Post, Law Firms, Opinions, Security, Technology, Training

-

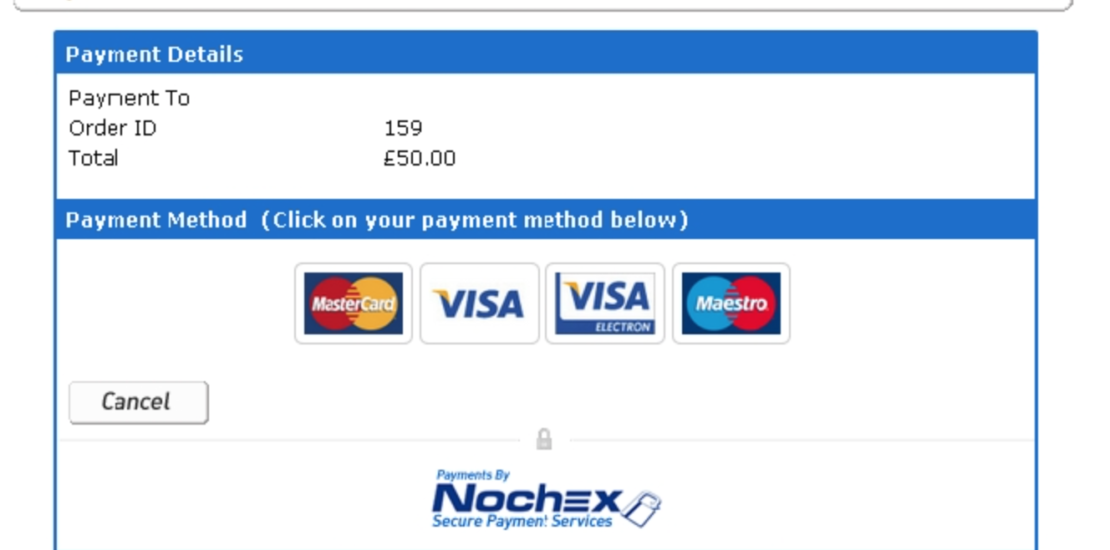

I Can Tell If Your Payment Website Is Effective By The First Page

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Compliance, Finance & accounting, Law Firms, Opinions, Regulations, Technology, Training, Uncategorized

-

The Top Three Reasons For Not Signing Up For FREE Consulting?

- November 30, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Jamaica, Marketing, Nearshore call Centers, Opinions, Regulations, Technology, Training, Uncategorized

how can we help you?

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.

see our gallery