Interviews

-

It’s Not Who Will Head The CFPB, It’s What Is The Future Of The CFPB?

- November 27, 2017

- Posted by: Phillip W. Duff

- Categories: Interviews, Jamaica, Nearshore call Centers, Opinions, Uncategorized

No Comments

-

Lighthouse Consulting Announces “Contingency Based Consulting For The Debt Collection Industry”

- November 12, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Interviews, Jamaica, Latest Post, Nearshore call Centers, Opinions, Reduce labor cost, Technology, Training

-

Do You Need A Better Solution To Your Labor Issues?

- October 1, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Interviews, Jamaica, Latest Post, Nearshore call Centers, Opinions, Reduce labor cost, Technology, Training

-

Naked Is The Best Disguise For The Collection Industry

- April 22, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Interviews, Latest Post, Opinions, Security

-

Are you brainwashing your staff to fail?

- April 22, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Interviews, Opinions, Training

-

Maybe You Can Join Me In Cleaning Up The Collection Industries Online Reputation

- April 7, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Interviews, Latest Post

-

Jamacian Call Center News

- August 23, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Interviews, Law Firms, Marketing, Opinions, Regulations, Technology, Uncategorized

-

“¡Me pica qué, me rasca aquí! Translated “It itches me here, but you are scratching me there.”

- August 9, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Interviews, Law Firms, Marketing, Opinions, Security, Technology, Training

-

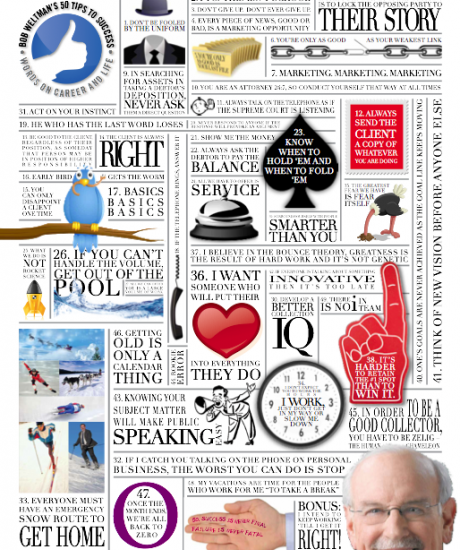

An Interview with Bob Weltman of Weltman, Weinberg & Reis, Co., LPA

- November 6, 2013

- Posted by: Phillip W. Duff

- Categories: Interviews, Opinions

-

Regarding debt buyers Dr. Wood stated “I don’t know if it’s going to be consolidation or just annihilation”

- June 19, 2013

- Posted by: Phillip W. Duff

- Categories: Interviews, Opinions

- 1

- 2

how can we help you?

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.

see our gallery