- November 6, 2013

- Posted by: Phillip W. Duff

- Categories: Interviews, Opinions

When interviewing Bob Weltman, my first question was, “When did you first enter the collection industry?” To which he replied,

“One summer I worked as an inside and outside collector for a local finance company and that was important because some of the policies that they had back then I later adopted here, I started with a law firm in September of 1962 and when I started with the law firm, that’s when I started getting involved with more full-time collections.”

I then asked, “Was that this law firm?” “Yes.” Bob said. “What was the name of the firm back then?” I questioned. Bob stated, “Gardner, Spilka and Weltman, that was my father. As I said before, I was born in Cleveland and when I was in third grade, right after the Second World War, my family moved to Florida. My father was a lawyer, one of the youngest lawyers in the state of Ohio. But he went into business down there and then after the 10th grade he moved back to Cleveland, which would have been 1953. He got a job working in a jewelry store and he worked at night, I used to see him typing and I would ask him what he was doing. He said “well I’m helping out the jewelry store to collect some money because I’m an attorney.” And sometime soon thereafter the owner of the jewelry store said to my father “I know these two attorneys called Gardener and Spilka that do collection work. Maybe you can make more money working there”, so he came over here working for Gardner and Spilka and almost immediately they named the firm Gardener, Spilka and Weltman after my father. When I started my first day at law school, the second time around, and I came to work here, Gardener had already passed away, so when I came to work here there were eight people working here. There was my father, Spilka, another attorney, a couple of bill collectors we had in a collection agency and a couple of secretaries and me.”

Then I asked, “What kind of debt will you collecting back then?” He responded “Department stores primarily and oil companies so the largest clients we had were department stores and oil companies.” “And that was all primarily local businesses in the Cleveland area?” I continued. Bob replied, “All local department stores and at that time Ohio which was part of the Standard Oil group. Then what happened was, I started here in ‘62 as a law student, I graduated from law school in ‘65, took the bar, and some time, I started in ‘62, sort of working outside running errands, checking court dockets, and sometime in ‘63 I asked my father what the people did in that other room and he said that’s our collection agency.” So I said to him, “I used to work in a finance company doing collection work, if I run to the court real fast can I come back there and work in the collection department?” and he said, “Yes.” So I went to work there and I asked him after a couple of days, “Did you make any money there?” and he said, “No.” and I said, “Why do you keep it?” He said, “Because at that time to be a trustee in bankruptcy, to be the trustee of the bankruptcy estate, the creditors used to elect the trustee, and so they gathered all the creditors at that time which were basically department stores and the oil company, and we had the majority number of claims and almost 75% of the cases, so that when a bankruptcy was filed they owed one of the department stores money, we had that department store elect us to become trustee since we had the collection agency , I said to my father “I think I can make money in there at the department. Can I buy it from you?” And he said “I’m not going to sell you a department in my law firm I’m going to let you run it.” So when I was in law school I started to run the collection department and by the time I graduated from law school most of the bar was shocked because they thought I was an attorney before that because I was running the collection department while I was going to law school.”

“Was the collection agency separate from the law firm or were they two separate entities?” I queried. Bob answered, “At that time there was a case that came down that said a lawyer cannot own a collection agency so they just collapsed the name of the collection agency and incorporated it into the law firm and then in the 60s the banks got into credit cards and my father’s partner Ted Spilka said “I represent all the banks and all their bankruptcy cases, they’re going to get into the credit card business and they don’t know what to do with it when they go delinquent. I want you to meet with the bankers.” So we met with the first local bank, we got that credit card business and then as all the other banks got into credit cards, I met with them to get their business. At that time the largest bank in the state of Ohio was Cleveland Trust and they went into the Visa card and I was introduced to them. Pretty soon it was starting to grow. Also going back in those days we used to collect in one month what we now collect in 30 seconds here, and I remember one of the department stores called me up and he said, “When we sue someone, we give you all of our judgments to collect the judgment, or execute on it, or garnish people’s wages. We want to get out of the collection work, we want to turn over all our inventory.” and so at that time they would give me three or four files a month, and I thought they would give me maybe 10 and so I went over there, and there were hundreds and hundreds of jackets. That’s when I took Scott’s red wagon and I would wheel it back-and-forth from the client, a wagon full of new accounts, taking them home setting them up, getting them in circulation. That’s how the collection process started.”

“So you were working off of paper then or off ledger cards?” I asked. Bob replied, “Not off of ledger cards, off of jackets. The first day with the jacket, then not too long thereafter we hired another attorney who used to work at Sun finance, that’s the Sun finance that I worked for, and he said “remember the old tabbies that they used to have where they yellows would be the zeros and then the reds and so we then develop collection cards where you put a number on it and the tabby would be the last two numbers. Then we put them behind dates and then the follow-up date and that card was where you made all of your notes on” and so that was the beginning of the cards so we went from the jackets to the cards.” I noted, “I remember that even more than I want to, personally.”

Next I asked Bob to what he contributed his longevity, to which he replied, “Focus. Are you talking about the firm or me?” “You”, I said. He continued, “Focus, you’ve got to stay focused. A lot of good people work here, a lot of hard-working people that have dedication and commitment. I’m very competitive so I treat everything I do with the competitive manner and so the challenge, the challenge, the focus, the commitment, keeping an eye on the ball.”

Then I asked Bob, “How different is collections now versus then, taking in for example the difference of working off of cards and working off of computers, and the challenges that technology brought, especially in the 70s and the 60s?” Bob replied, “What happened is the office began to grow and it became more and more difficult to locate cards when someone would call up because the card would also be your method of collection, your method of matching mail to it, the method of litigation.” “And accounting payments.” I added.

Bob stated, “I had a partner back then, may he rest in peace, who said that maybe a computer would do it so back in the late 70s early 80s we were one of the first law firms in the country to bring a computer in, in order to organize it all, so that it would be instantaneously at your fingertips. The biggest change obviously is technology, I mean technology really drives the business, and it’s obvious that without technology you can’t run an operation, because it’s important; the technology just speeds up your ability to recall things and to gain access to information, and so technology is the biggest change and also the industry as a whole has gone from one of performance, to security, to compliance. So it seems in the beginning where the clients were more interested in how well you perform and how much money you collected for them, today they are more interested in how you are keeping them out of trouble not so much how much you collecting. The clients have said to me several times “we’re risk averse, so if you have to pass up on a collection that would improve our bottom-line, if there’s any risk involved in it at all, we don’t want you to take the risk, we’re risk averse.” The mentality of the client has changed and also technology has become a big boosting step in helping the industry.”

Next I asked, “Give me some idea when technology first came in, how was it even more challenging to you then, actually probably the cards were because I’ve seen that before, or was it?” Bob answered, “First of all when somebody said a computer I thought it was a typewriter you wheel off the elevator, you plug it into the wall and go to work on it. I’ll never forget the day that they wheeled off the first IBM computer and they said to us, “where’s your air conditioning room?” and I said “what do you mean air conditioning room?” and they said “we can’t put this big huge computer in a room temperature room, you’ve got to build an air conditioned room.” So we had the computer sitting in a corner while we built an air-conditioned room. They said to me, “where’s your programmer?” So just the entire intelligence of what a computer was like, the conversion from the cards to the computer, taking the time and then of course once you’ve mastered that, the programming of the computer, Scott described to you before that we have an HP homegrown system. The system that we had was all drafted by me, the logic of the system was drafted by me and the yellow piece of paper of the flows that I wanted to have down and so the intelligence of the computer had to be put into the computer and somebody had to program. The programming took forever, we financed the computer and I think that within six months of the computer that we financed over five years we outgrew its capacity, so we’re constantly upgrading, constantly refinancing the computer so we never really courts up with the payments of the computer It allowed us to operate at a higher volume and allowed us to operate in a more intellectual manner. We never got the whole system converted. We always talked about phase 1 phase 2 and phase 3. We got phase 1 done and that’s exactly where we stood.”

I added, “One of the things that’s changed a lot, I entered the collection industry calling nearby’s, calling same last names, things like that, Skip tracing and of course back then we used to actually call the other banks, and whoever had the cards. Tell me how Skip tracing has changed over the last 30 years.” Bob replied, “Because of all the laws that now exist out there you can’t share information with anybody. You’ve got the fair debt collection practices. They have PCPA which makes it more difficult to do the things but now you still have access to credit reports, but I think the Internet, those people that know how to search the Internet has made Skip tracing easier today than it was back then. You have online access to court and so I find it very handy that when I’m looking for somebody I can go up and check all the courts in the local, areas where they are and the federal court system. What you used to gain by calling nearby’s and other creditors, you more than gain that by all the online access that you have and I think that the collector today can do a much better skip tracing job if they know their way through the web and how to search in different search sites.” “It’s definitely changed.” I stated.

Bob said, “Yes, to the positive; real estate records, death records, bankruptcy records, now everything’s online with bankruptcy, you can search bankruptcy records, so there’s a lot that you can search that you couldn’t do before, property ownership, you can zero in, you can go through Google, view and look at someone’s home, you can see the neighborhood there and you can see the condition of the home, you can see the condition of the neighborhood, so there’s a lot that changed. You can get appraisal value of real estate, so it’s easier today to do skip tracing than it was back then.”

Next I noted, “Nowadays compared to when I began in the industry, actually taking a payment from the debtor is a whole lot easier. Talk a little bit about what you used to have to do 30 years ago to actually get the payment from the debtor. Nowadays they can take it over the phone but back then those options didn’t exist.”

Bob replied, “I always tell the story, which is one of my favorites; when we were very small, I used to come in on Saturdays and open the mail, that’s how little mail we had, and I remember the day before I spoke to someone that lived in one of the local municipalities and I called him up, and I said “you didn’t make your payment”, and he said “I’ll mail you hundred dollars tonight”, and the next morning when I was opening the mail there was an envelope from that suburb area, we didn’t have that many accounts back then that I knew everybody who paid back then. I opened up the letter and there was a $100 bill with no letter so I called the guy up on the phone and I said to him “you promised me a payment you didn’t send it to me”, and he said, “yes I did mail it to you”, so I said “well then you better call the bank and stop payment because I haven’t gotten the payment”, and he said “I didn’t pay by check”, I said “well how did you pay?” he said “I mailed you $100 bill”! OK, so back then the only two ways to pay was to mail it or come in in person. When we first started we were very local in our collections so we sort of confined ourselves to northern Ohio. The people would either come down to the office and make a payment in fact the department that I took you through which was a real estate department, and is used be the collection department there was a window there that where people would come, and make them payment today, or they would mail it in. They can do it online today so we’re hopefully migrating to more online payments where we can get the payments instantaneously. It’s much faster.”

I told the story way back when I started GC services is where we used to get a debtor first of all to write out 30 or 50, a whole book full of postdated checks and then we would get him to go down to his local Greyhound station put that on greyhound package express so that it would go on the bottom of the bus from wherever and bounce around before it got to RC. Our collection manager would go over three times a day to Greyhound and pick up our payments and then you had to find a ledger card to post a payment to and then the first check bounced, and that’s just the way it used to be. Kids today have no idea how easy it is for them. If they ever tried to talk someone into sending something Greyhound package express, they could never do it.

“What’s has turned out to be the best advice somebody gave to you many years ago?” “Work hard”, Bob replied. “Who gave you that advice?”, I asked. Bob responded, “I’m also a very good sports fan, a huge sports fan, and I like to look at people that have been successful in sports and I like to look at how hard they’ve worked to get to where there got. I’ve read a lot of books about successful people and it was obvious that they didn’t work 8 to 5, they worked 24 seven and so I have always been a firm believer in that. When I was younger I played a lot of sports and I was head of many sports teams and I always felt that practicing often and doing a lot of repetitions makes you better and so I’ve always lived like that. It’s how my father worked. My father got up early in the morning went to work, pounding away early in the morning on his typewriter in the basement on lawsuits for the jewelry stores and so that was a pretty good message. I’ve also worked and gone to school so I never was in an eight to five person so even when I went to college I took a double load of courses, not just the normal load and then I would still have jobs in between so there was very little downtime in my life where I’m always doing something to keep busy.”

My next question to Bob was, “How do you think that your love for sports has helped you in your business? Do you think that because you believe things like training and development and those things, do you think that’s been something that’s been stronger for you because there’s are a lot of people in this industry that are not as strong into that training development coaching type of management?” Bob answered, “The first thing I learned is that to be a good collector you’ve got to be a good salesperson so you have to learn how to speak to people. You have to be able to convince people what to do when you’re dealing with debtors. You’ve got to make them feel important. You can’t pound on them am browbeat them. You’ve got to talk to them like a human being and work with them. If a debtor were sitting outside the office, I would shake his hand, remember who he was, make a comment about his wife, make him feel important. There is a connection to name recognition. I know that in collection work the more you get your name out there the better the results will be. You know, indirect advertising and so I found that in sports I looked at the great athletes what did to become great, the commitment they have to the job, the practice they have for the job, so I combined a lot of those skills plus a lot of good marketing skills that I’ve learned and picked up over the years.”

I asked, “Where did you pick up those marketing skills?” He replied, “Probably from reading a lot about people that have been successful. Also learning from commercials. If you see a commercial you see a product and the repetition of the product over and over again, it makes an impression. Getting my name out there very early on in my career helpful. I was the sole marketing person with the firm and people used to say to me and no matter where they went I was there so the more your name is before your client the more you put before you client more you put before the public the better it is for name recognition.” “I fully agree”, I stated.

Bob continued, “So we have a very robust marketing department here as you can see as you walk around just in the building itself. The amount of marketing things that we have hanging around there to help the employees with their job.”

My next question was, “What do you think someone needs to do to succeed in today’s current collection marketplace? The whole market has changed completely, you know, even just over the last 10 years, so what do you think is most important in today’s environment to succeed?”

Bob’s reply was “To learn. We have a very good mentor program in the law firm and I’ve agreed to be a mentor. You need a mentor so I have three young attorneys that worked with me. I think that I teach them by example. I teach them by the hours I work, the intensity I work at and the example I try o set. I think like anything today, it’s a highly competitive market. I think they’ve got to learn the basics, you know you’ve got to learn what it is. First, you’ve got to learn the industry, what it’s all about. You’ve got to read about the industry, you’ve got to read the journals, you’ve got to read the success stories, you’ve got to work in the environment you can’t be afraid to get your hands dirty and I think it’s like anything that you learn. I have seven grandchildren and three of them are boys that play sports. They started off at the bottom league, they started off with T-ball baseball, and just to watch the progression, to watch the training which the dedication and the commitment made them become better athletes as they are right now. It’s the same thing in the work environment. I think that you’ve got to start at the bottom, you’ve got to learn the industry, you’ve got to learn where you work and you’ve got to learn to follow the good people and act like the good people to try to become successful. So, I think the basics are still there and I think obviously the younger generation is much more tech savvy than I am and so they are light years ahead of where I am far as learning technology on the job. But at the end of the day, collecting money, asking someone to pay on a bill and getting them to pay it, is what it is really all about.”

I stated, “I’m a firm believer in some of the things you’re saying about training and development and having a good strong background, but that doesn’t exist a lot more in this industry. I noticed as a consultant that somewhere around 2005 to 2007, most of the big agencies and law firms that I dealt with quit training, because they didn’t need anybody that was smart to collect. Back then all they needed was an order taker, just turn on the dialer and you put someone on the phone to take the money and so most everybody quit training and developing and I think that’s really hurt our industry right now. I’ve got some of my clients that say, “listen, go out and find me a high end manager to run my office.” Well the only high end managers that are truly qualified now are either my age, 50 or older, or they don’t exist anymore because the ones that should be there, that should’ve been developed along the way, that should be around 35 to 45 years old, aren’t there because we quit training them. Why do you think everyone else quit doing that?”

Bob responded, “In terms of the compliance education and training and testing. That’s a given, we also do, I’ll say, corporate level training, what we call WBR. You get to learn about business skills, life skills, some of the basics, how to sell. But we are talking about collections in general, obviously there are very robust training systems, training mentoring, the training side-by-side, if appropriate and obviously all of the stuff is training.”

I then said, “It’s the continuing development that everybody drops the ball on. They bring someone in, they train them for a week, two weeks, a month, whatever period of time, then they leave them alone, and they do not understand. When I started GC services you started out as a bill collector and within so many months they were going to move you to a unit manager and you got moved up the ladder kicking and screaming whether you wanted to or not because that’s what they did, and by doing that, GC services created a large majority of high-end people today who still running a lot of agencies, but I don’t see that in the average shop anymore. I just don’t see that continuing development.”

He said, “I can’t speak for other organizations, but all I can say is we had that huge wave of expansion and consumer credit where you could be successful just by tripping over yourself, so now there’s been a sizable cut back. Those organizations will not survive; they will not be around for that reason. We were located in northern Ohio. Mr. Weinberger was working for me and Mr. Reese had just started. A credit card client said to me “if you open up in Columbus we’ll give you all of our work” but at that point I had no idea even how to open up an office, let alone to expand, so than the banks came to me, because I was very tight with all the banks when they got into the credit card business, and they said banking is going to go statewide, if you open up in Columbus, we can give you all the work in the state of Ohio, so I went to Weinberg who was just a young attorney, and I said do you know anybody that can open up our Columbus office? He said, “Al Reese used to be from Columbus, he went to school there, he will go down there.” Al Reese grew up under my tutelage and worked with Mr. Weinberg and me. He was experienced when he went there. Every successful office that we had was all run by homegrown people. Those offices that we tried to bring new recruits in, recruit or merge without firms have all failed because they were not homegrown and so training is essential to the all or merge without firm’s organization. When I started here I had no one to train me, I was the boss and I did whatever I wanted to I did it on gut and that’s how we learned. We weren’t as fortunate as Scott’s generation and all those people were who worked for us there’s no doubt who worked for a spent many years and got the training that was necessary and there’s no doubt that the next generation of the firm which is Scott’s generation is gonna carry this firm to heights unseen before, and in fact even today as we talk, Scott’s already decided about the next generation , so here it is Scott’s , his generation is now taking over the management and leadership of the firm and should have no problems at all because they’ve had sufficient training by watching the way veterans did it,, and the way we’ve done it and the way we work. There is no doubt that they’re are going to hire so we’re already planning on the third generation today. You see signs all around training in progress. We have compulsory educational courses, we encourage people to attend conferences we’ve been trying to engage ourselves everything known to learn. When I used to go to conferences, I didn’t go to conferences to be with the good old boys and sit around and drink beer and play golf. I don’t drink, I don’t play golf, that’s not a bad mark to people who do. I would go to the conferences to hear, what are the problems people were having, and then I would take them all together and gather them, and on the way home I would try to figure out a solution to that problem, so everything I’ve done has always been to learn and to train and to solve problems and that’s how the firm grew, and so that continues on today as we sit here, even more so today than when I was in college.”

I next asked, “Do you still have that passion for knowledge that you obviously have had for a long time, is it still just as strong with you today?” Chuckling, Bob answered, “I don’t know.” I followed with “Are you still reading books? Are you still reading that kind of stuff?” Bob replied, “Yes when I’m on vacation. Scott told me to read Steve Jobs book. I read his book. I was blown away by it, absolutely blown away by it.” I agreed, “That’s a good book, and I read all that stuff like crazy too.”

Bob continued, “and then of course the next book I read was Rev. George Steinbrenner’s book, and that blew me away even more so when I go away those are the kinds of books that I read. Those about great people and famous people and how they achieve their success.”

Changing the subject, I asked, “How would you compare the installation of the CFPB be with the passing away of the FDCPA in its day?” Bob responded, “We don’t know yet, we don’t know. I know that we’re gearing up. I know that it became obvious about two years ago when this came down that we better get our act in gear. I know that Scott is very much behind making sure that we are prepared. I know that clients, as Scott told you, the trickle-down that was that CFPB will be coming in to see us. They have, indirectly through the clients that are coming into see us. I know that with passing the audits with regularity. I know that several times he said we are further ahead than anybody else out there, that’s the way I want it to be. I’ve always said that the CFPB and the entire regulation is going to be a huge marketing tool in the future, I think that once we are visited by the CFPB, that we can go out and sell our compliance. I think that no longer can we tell the client that we can out collect you, no longer can we tell the clients that we are the hardest working people, no longer can we tell the client that we have the best lunches, and the best sports teams, no longer can we tell the client that we have cameras everywhere, and we’ve got badges even Bob Weltman wears a badge. Now we can tell them these are the things we are doing to keep you out of trouble, and I think that’s going to be a huge selling point, a marketing point for us in the future as we redirect our marketing in that direction.” I said, “I agree.”

Bob said, “Fast Eddie Watkins was a bank robber, and Fast Eddie Watkins spent more of his adult life in prison than he did out of prison. Fast Eddie Watkins was an inmate of the Ohio State penitentiary and was scheduled to be released he begged them not to release him because he didn’t know how to adapt to society, he had a better life in there, and the reason why I know these stories is because a husband of one of my wives closest friends was a psychologist and knew who Fast Eddie Watkins was, and he said, “Eddie we can’t keep you around anymore, we’re going to let you go. He walked out went into a local bank, robbed it, the day he got released, took the money to a field in the suburb and burned the money in a field and surrendered and went back to prison. That bank called me sometime after that and said we got word that Fast Eddie Watkins is writing a book, and they’re going to make a movie of him, and we want to give you our claim because we are self-insured and we want you to attach the loyalty rights from the book and the movie. So I sued Fast Eddie Watkins, when I got an anonymous phone call that Fast Eddie Watkins maintained a bank account at one of the local banks, it was a Christmas account, where he was putting money in every month. I could not reveal my source and I couldn’t just attach that bank, so I had somebody drive in that neighborhood, and give me the name of every bank on 25 streets of that street and I filed an attachment against every one of those banks and hit the bank that I wanted to. I went to court, the judge turned to me and said “how do you know the money was at that bank?” I said “your honor you note that I tagged every bank that was in 25 blocks where Fast Eddie Watkins girlfriend lived or mother lived.” That’s what I did. The judge was so impressed by that he went to the papers and told them about it. I got written up in every magazine about Bob Weltman is the only person ever to get money from fast Eddie Watkins. Now that story sat out there and about 20 years later, couple years ago, I got a phone from a guy like you saying, “I’m writing a book about famous characters from Cleveland Ohio. We have all the gangsters in there, Chandra Burns, John (?). The movie they made about the guy, Kelly, you know the guy that blew himself up you know we’ve got all and one of the characters we ran across was Fast Eddie Watkins I understand you’re the only person ever to collect money from him. I picked that up online so I was included in that book Fast Eddie. That was probably the case that got my career started with the publicity in this article hanging like that somewhere on the walls right here.”

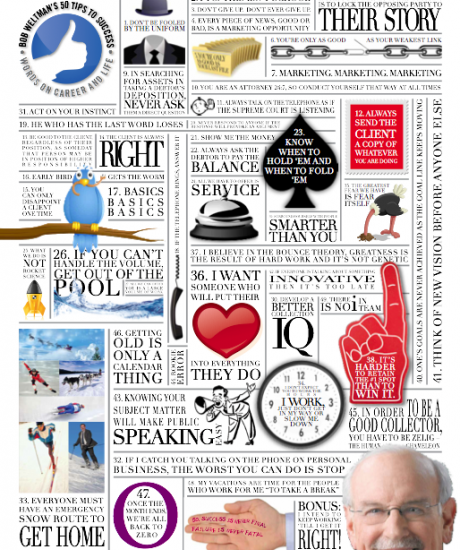

I next asked, “Do you have any other interesting stories such as that that you’d like to tell?” Bob replied, “There’s so many stories I don’t even know where to begin. And what you looking at there is that I started with the firm in September of 62 and so in September of 12 it was my 50th year of the law firm. The law firm decided they want to do something. I obviously didn’t want anything to be done but we rented the lodge at the ballpark and had a special night there for me where I was recognized so on and so forth. They asked me to give them 50 of my favorite one-liners and these were some of the ones that I rattled and wrote down. You can only disappoint one client at a time?” “That’s funny”, I said.

Bob continued, “It’s so important when you do collection work, both from the client’s perspective and from the debtor’s perspective, that it’s how you’re looked upon by the client and the debtor. If the client looks at you as someone that’s interested in just making money off of you, you won’t get their business. You’ve got to sell it to the client, not so much today because the way the things have changed, that it’s a partnership, that I’m in it with you, and that if you’re successful, I’m successful. We’ve been conducting educational courses at the client level for 30, 40 years. We always said that if the client is well educated, it makes our job that much easier. I had internal clients at banks that have gone from one department to another, and when they left that department they left to go into the collection department, I would say to them, I’m going to give you suggestions of how you can save money, the work you’re giving to me, you’re leaving money on the table. I would not be sending this kind of work to me, and I think you can do a better job internally and so I try to work with the client, to give them cost-saving ways to conduct business, to establish a relationship with the client more than just being a salesperson, but when I deal with debtors one of my favorite questions is “what would you do if you were in my position and I told you the story I just told you? What would you do?” And I try to make them let them help with the solution so I tried to work with debtors; I try to work with clients to come up with the best possible solution. When people come in here to interview me, to represent them, similar to what you said, I say to them I don’t want to lose out the opportunity to accomplish what you have to have done over how much money no one else going to do the job that I can do and therefore give me the file let me handle it and you pay me at the end what you think it’s worth, so as you know there’s a lot of sales work that’s got to go into establishing a relationship, and it’s important that your employee buys into that, that your clients buy into, that so we’ve always been client focused in all the years that we’ve ever represented the clients. The people that have helped make the organization successful, are people that have bought into that culture. You get a lot of new people here at a high management level and they say the cultures got to change and I say what is the culture we have and what are the changes going to be without us compromising what we do best. Were the only organization today doing what we do that was around 50 years ago when we started.” “Very true about that”, I mused. Continuing, I said’ “If you were to give any advice to someone entering the industry today, what would that be?” Laughing, Bob said “Go find another job!” “No, no, as I said before, credit is very much part of what we do. In addition the firm has always been ahead of the curve in many of the areas that we’ve entered. We were the first law firm to have a computer; we were the first collection law firm to open up in more than one locale. We were the first law firm to develop a probate collection operation, so we were diversified in that we were in many different areas, so where consumer collections is still the backbone of the organization, we also have a very robust bankruptcy department, a very robust real estate foreclosure, a very robust commercial collections unit, and so on and so forth, but we’ve always seem to be an incubator for new ideas in the market place, and so what I would tell someone entering the industry is, I would tell them to get a job at a collection organization for 3 to 5 years and learn what it’s all about. The learning education is very important part of what you do. There aren’t a load of clients sitting out there and in today’s world clients aren’t looking so much as how much money you collecting them, but they looking what you doing to keep me out of trouble so I think you’ve got to learn what it is to work in an office. I got a guy in here the other day, and was on a business loan, and I said to him how long have you had your business? And he said,” about five years.” I forgot what industry it was in, and I said, “What did you do before that?” He said, “I’ve been in this industry about 20 years.” I said, “What happened?” He said, “Well 15 years I worked for someone and I saw how much money I was making for the guy and I decided to go out on my own.” I said, “What happened?” He said, “I underestimated what it was to own my own business.” I said, “Yeah you got to make sure the lights are on, you’ve got to make sure the air-conditioning and heat is working, you’ve got to make sure that the people are paid, you’ve got to make sure that you can manage the place when people don’t show up for work, you’ve got to learn how to run an office, you’ve got to make sure the supplies are ordered, and so on, so forth.” I said, “It’s a lot different than when you work for somebody.” So he said, “Yes. To go into this industry, it depends how you want to go you want to go into it, if you want to go into it as an employee, then you’ve got to buy into the training courses that are offered. If you want to become your own person, run your own firm, you better work for somebody first because it’s hard to go out there and start on your own. Training. That’s it all it comes down to, training.” “I’m so glad you keep saying that,” I responded, “because I’m a firm believer in that, and I wish everyone else thought that way. Our industry would be a lot better.”

Bob stated, “There’s a book I read called “Bounce” and it was the discussion whether greatness is hereditary or is it self-made, and the theory out of that book is that every great person whether they be a swimmer, a baseball player, a violinist, whatever it may be, all practiced their trade something like 10,000 hours before they achieved close to the level of success, and then they talked about the fact that all these foreign runners that run the Boston Marathon are all from some place in Africa. He said you look at where they are from they are all from a very central place where the school is 20 miles away from where they live. They used to run to school and run home from school every single day and that’s how they developed the endurance, so I’m a firm believer of that.”

Next, I asked, “What advice would you give the industry as a whole if you could have had everyone from the industry in one room and you could say here is what we need to do?” He quickly replied, “Clean up our acts, clean them up.” “Self regulate?” I asked, “How?” Bob replied, “First understand what’s right and what’s wrong, I mean that’s the first thing. You’ve got to know what’s right; you’ve got to know what’s wrong. You’ve got to get into the bowels of the client that you represent and find out what are their problems and where do they need the help. No shortcuts; there are no shortcuts. There are a lot of shortcuts offered out there. There are lots of deals offered to people to do the work, and so I think that you’ve got to brush up more today on the regulations then you do on anything else and that’s the biggest part. You’ve got to master the FCDPA. You’ve got to learn what the Consumer Finance Bureau is going to do, CFPB, you’ve got to study that to the point where it becomes a second nature to you, and I think that everybody’s got to clean up the act. The job is not hard; it’s not rocket science. It’s the volume, managing volume. I can tell within two days when I hire an employee whether they are going to cut it or not. You can just tell either they have it or they don’t have it. It’s the ability to manage volume. I think the industry is lazy. I forward claims to attorneys, you don’t get acknowledgments, you don’t get reports, there’s no sense of urgency in what you’re doing, so there’s a lots of things. I think that clients are badly neglected. I don’t think the clients are getting the service they deserve. I don’t think we understand the clients business, what the problems are, and I think you’ve got to modify. I always tell the client that I’m a complement to what they do. I pick up where you leave off. I’ve got to understand where you are, where you’re leaving off. I’ve got to understand what you want, what your goal and objectives are, and I’ve got to meet them. It’s not the same for everybody; every client is different because it’s a different type of product and its different person to deal with. You’ve got to learn what it is that the client wants, and you’ve got to be able to service them. So I would say to them that we have to do a much better job in running our own shops to be successful. The wave is over with. It’s like buying in the stock market. When the markets going wild you can take a dart and throw it at the wall and everyone can win, but when times get bad you’ve got to do a lot more study and understand that the market the market is changing. The collections are going to be more difficult, the banks have finally awakened and have decided we are not going to give credit away; we are going to be a little bit more selective. That’s why I feel a collection law firm has it way over the average collection agency if the clients are doing their work. If the clients have a robust internal collection by the time you get the account, if you do things properly, it’s going to be difficult to collect it, that’s when a law firm that has a combination law firm agency built-in, you’ll be more successful. In the early days when we would be competing against collection agencies, we would be very slow out of the box, but we would pass the average collection agencies somewhere around 8 to 9 months out, and the problem that we had was that we spent more time in developing the legal strategies instead of the collection strategies.” “We’ll, you’re lawyers, what do you expect?” I laughed.

Then Bob said, “And that’s another thing. It’s hard to sell the public that lawyers can do collections work. So we developed, if you go out to look at our operations out in the suburban area, you have a front-end collection and you have post litigation collection, so when business comes in we have a very robust collection agency approach on the front-end that slides very neatly in the litigation stage after a certain period of time. Unless a client wants us to do it right away and as a result of that, our results are better. We have no competition. The only competition we have is ourselves. We shoot ourselves in the foot more often than not, so if we do everything right, if we do everything timely, for example, I don’t know what we average, we get about 100,000 payments a month, that’s what we put through in northern Ohio only, and I know that now that we scan payments to the bank there’s no more checks bouncing, and I know that today is the last day of the month, yesterday is the next last day the last three days of the month probably account for 20% of all our collections, all of the ACH payments and everything else.

I know that. I got an email last night. My day starts the night before. I’m 75 years old. I’ve been doing it 50 years. My car is loaded right now with maybe 15 to 20 boxes of files. I go home, I have my dinner, I go in my office and I work there. I work from the time dinner is over with till time to go to bed, 10:00, 10:30.

In the morning somebody greets me at the side door at 6:30, my daughter, and she helps me unload the boxes at 6:30 in the morning, take them upstairs. I’m unloading the boxes, putting the files where they go based on what I do, and the day starts. So my day starts at 6:30 in the morning and ends at 10 o’clock every night Obviously, I go to baseball games. I go out socially with my wife. Just like my life in college, there’s no downtime. It’s important. So last night I got an email that says that the scanner at the bank will not accept the payments, and as a result the people were all coming in early this morning to scan them through because the scanner at the bank was broken down. And then there was another email that came in that said and by the way, the accounting manager said, I want to apologize to the rest of the firm, we have about 250 or 500 payments that are left over that were not posted yesterday because of all the trouble we had in getting this through. Okay, it was open communication that’s another good thing if you do something wrong, tell the client. We are a very, very forgiving nation. Let the client know what happened before they find out. These are all simple rules.” I added, “It’s the same thing if it’s your boss.”

Bob said, “Right, right. If you do something wrong, tell your superior, tell your client. If a client calls you up and says what have you done with my file? Tell them I just haven’t gotten a chance to get to it, you have every right to recall the file or you can allow me to handle it, and I will get to it today. If I don’t then you have it right to recall it. That’s the hardest thing in the world to just be open and honest, and don’t give the client the impression that you’re in it for a profit, give the client you’re in it to help them and assist them because, this is not a one-time relationship. You’re building a long-term relationship. Here is another war story: I’m sitting in my office one day and the secretary to the head of one of the banks, the collection department, calls me up and he says “Mr. Brownell wants to see you in his office right now.” I said “What about?” She replied, “He didn’t tell me he said just come up.” I go out there, and I walk in the room and he’s sitting at the head, and there’s a circle of chairs around there and he puts me right down the middle, and he says “You owe me $30,000.” I said What for? He said “Are you a man of your word or not?” I said, Yes I am. He said “You screwed up on a file and I figured the value of that file is $30,000. Are you gonna pay me the $30,000?” I said, If I screwed up a file I will definitely pay you the money. He said, “How long will it take you to get the $30,000?” I drove back to the office, I told my father who was livid about it. I don’t know where we are going to get $30,000. I said, I didn’t know what to do, my partner who introduced me to computers said, “Do you think this clients worth $30,000?” I said, Yes it’s a bank. So somehow we agreed to it. I drove back out there I said, Yes, I’ll pay you the $30,000 just make sure we have the ability, I said will you tell me what it’s all about? He said, “One of your people handled a bankruptcy case, some kind of fraud, and you approved the reaffirmation for less than we would have approved it for. We figured that the amount of the loss was $30,000.” Well, there is no way we would do a reaffirmation without your approval. He said, “No one in this room, and I’ve asked every one of them, told me that they approved the reaffirmation.” I said I owe you the money. He said, “Okay when you give us the check we’d give you the claim to collect. It was the reaffirmation for like $90,000 but if you paid $60,000 within a period of time we’d accept it, the present cost of money back then was $30,000.

So I went back and I spoke to the bankruptcy attorney and I said, Tell me what happened? And he said, “I called Randy and Randy approved it.” I said Randy was in that room. But I could understand. It was Randy’s job versus $30,000. So we paid it and I kept the reaffirmation. The guy called me several times to settle it. I said you’re not settling this for a penny, I hope you default so I can go after you for $90,000 instead of 60. Eventually I got more than my $30,000 back. That story lived in the halls of the bank for years; for years, for generations. This is PNC that became National city Bank was putting its work up for bid. They had hundreds of attorneys throughout the country; they wanted to go to one law firm. My contact said we want it to be you. I said how do I do it, I’ve never submitted a bid before for a client? He said send me the bid ahead of time and will make sure you win it. So I win it, and there was a meeting held in this room. All my friends were there. There was a new person there. I said I really appreciate the opportunity to do it. He said you not only got this because of the quality of work that you do, but because you are a man of your word. And you paid a claim on an account you didn’t have to pay.

Several years after that I ran into Randy; who is now retired. You’ve got to tell me the truth I hope you understand I said of course it was your job.

Randy did not make the final decision. An entry-level collector made that decision and that entry-level collector to was told by Randy who was told by the head of that if Weltman doesn’t pay the $30,000, you collectors are fired. That collector that day had just bought his wife, his girlfriend a ring to be engaged to her. That collector is today President of PNC Cleveland.”

I added, “Interesting and that’s something I always say. People say, how come you talk to so many people, ( when I go to an agency I give everybody my card, every collector), and they go “Why’d you do that?” You never know who this guy may be one day. You never know who he’s going to be one day.”

Bob said, “Work the room, It’s one of the sayings out there.” “Work the room?” I asked, Bob replied, “No, no right here. Be good to the client regardless of their position. Someday that person may be in a position of higher responsibility.” I responded, “There you go. And I’ve actually had that happen to me, years later, here’s the guy, I will give you a perfect example. I started working at GC services in 1979 working off of ledger cards. The guy that was sitting next me was a guy by the name of Frank Taylor who owned the Coke machine. I thought he was so entrepreneurial because they wouldn’t buy a Coke machine for the office, so he went out and bought one and he makes all kind of money out of it, a quarter for Coke, he spent half the day giving out change. Frank is now the CEO of GC services. 37 years later. He never even wanted to be an assistant manager back then, but now he is the CEO and he’s just some dude who sat next me and owned a Coke machine for the sake of it. That’s funny and I didn’t even know he was a CEO. When I started doing the research for these interviews I said well let me go in see if I can find J B Katz. I started calling around asking some of my other buddies who used to work there and I said who’s running this? Frank Taylor. Frank? Frank used to own the Coke machine yeah, oh my God so you just absolutely never know.”

Bob said, “Larry Rothenberg, you’ve met him, the little guy at the back there. I gave Larry Rothenberg a file (first year attorney) and he came to me one day and he said I’ve got a problem I said what is it he said I blew the statute of limitations I said thank you for telling me, I’m a professional problem solver. Thank you for being honest with me, now I have to work around it. So when you know the truth it’s easy to work around, and there’s a story where I park my car not this location, but another location, in a lot. I go out to get my car in the parking lot attendant comes up and he said did Frank tell you what happened? I said no. He said Frank was backing his car and rammed into the pole and there’s a big dent in the back of your car, I went back there and sure enough he said I told Frank to please tell you because I don’t want you to blame the parking lot for doing this. I said well Frank is the errand boy; maybe I missed him. The next day I told my little Kim up there, I said when Frank comes in let me know. He came in. Frank was walking this way, I walk this way and I said good morning Frank and he said good morning Bob.

On the way back and said Frank have a nice day, he said same to you Bob. Now at that point I don’t think I had an HR director whatever I was the boss. I called Frank in and I said you are fired. He said why? I said I said because you are dishonest. He said what do you mean? I said you backed my car into that pole, and you didn’t tell me about it, and I gave you two opportunities, and the only thing I could do was blame the parking lot for doing it. That isn’t the way I operate. You’re out of here.

I said you’ve got to be honest. I’m huge risk taker. I’m not afraid of failure. I didn’t think I was a pioneer in what I did. I never feared anything. You know when the computer blew up in one of the conversions all I did was go to the company. The company was going to repair and I said I don’t care how much it cost I don’t care how long it takes you I don’t care How many lifetimes I have to work to repay you we’ve got to say this operation you’ve got to fix the computer simple as that. So my number one lesson if you’ve got to take a risk if you’re going to take a chance and you fail you better be man enough to stand up to face the consequences, and that’s it, that’s a simple rule for everybody.”

I recalled, “I’ll give you a perfect example of exactly that. About six years ago a guy called me up, I’d heard of his name, but I had never met him. His name was Steve Goldberg and said listen, I want you to help me sell some debt and I said Steve, I don’t really know you that well, where are you from? I used to be at savers. Okay that’s what I thought; You’re the guy that was the VP at savers. So I did a little quick checking, to check it out. This is December, so I said I need a copy of a bill of sale. He shows me a signed contract with Brian Falerio’s on the bottom of it from Sherman, I’ve seen the same signature a million times, I’m good.

I start selling off states. I sell 13 states in two days good GE paper, good prices, and the next day we are doing a call with one of the buyers, with Goldberg, and his answers to the buyers questions were not wrong, but weird, and just weird enough that I , that’s a strange way to answer that damned question. I could not sleep that night. I just could not sleep. I kept thinking something’s wrong, something’s wrong, something’s wrong. The only thing I could think of that was wrong is that he didn’t really own that file. But I saw the contract, so I said the only thing I can do is get up in the morning, wait till 9 o’clock and call Brian, because I know Brian. I call Brian, I said Brian this is going to be a stupid question, you’re going to laugh me, you are going to think I’m dumb, but I’ve got to ask this question. Did you sell a file to Steven Goldberg? He said yeah, but he never funded it. I said how does he have a signed contract? He said I screwed up. I said how does he have unmasked data? He said I screwed up. And I said “you don’t know how bad you screwed up, let me tell you how bad you screwed up, let me tell you what I’ve done to screw you up even more.”

And so I go out and I realize I figure out this is the end of my career. I’m gonna go tell everybody that I did this, but that’s what I’ve got to do. I call DBA, ACA, I called everybody I could call, and and them what’s going on. Even one of the people that I talked to had already actually been screwed by them, and wouldn’t say anything. Which kind of pissed me off. And one of people I asked for a reference on already knew that there was a problem, but wouldn’t tell me, because they won’t admit they had been ripped off. That’s how people in this industry are. I was exactly the opposite and in the long run that turned out be a great thing for me because people believe me even more. I figured I would have to get a job at 711 or something. I figured I was done ever brokering a piece of debt for the rest of my life. Of the eight people I sold out to, only one of them is still mad at me, even though they lost their money. They didn’t get it back in most cases. Some of them got some of it back. And he went to jail, and I got the Boca Raton and the feds and everybody involved and him, and he went down, and I knew I could only do one thing and that was the right thing, and I was even upset at how badly I had to push the DBA to take his membership away, and they waited to actually at the DBA show to do it, he wasn’t even there, but all these things. I had to push so hard to do the right thing, which to me seemed like I shouldn’t have never had to push that hard.”

Bob stated, “But you can’t compromise that, the important thing is that you’ve got to teach young people what’s right and what’s wrong. And you’ve got to tell them there will be times when you want to waver from that, but you can’t waiver. People have always asked me. “Has a client ever approached you to give them compensation or bribe you to get the business? I’ve heard stories that so and so gets all the business because he gives this guy money under the table, and I said to him, “I broker debt. I know brokers like that.” Bob continued,” And I said to him I’ve only been approached once, only one time in my entire life was I ever approached, one time in my entire life. Cleveland’s first black Mayor in the country was Carl Stokes from Cleveland Ohio; Carl Stokes was the first black mayor in any city. Carl Stokes left here and went to New York, and Carl Stokes went into television and radio, failed there badly, came back to Cleveland. Carl Stokes brother, Lou Stokes, was a Congressman for maybe 50 something years, a household name. You drive around Cleveland, you see the Stokes name, you see on the federal building. Very, very well known. Carl Stokes was back in Cleveland, the city of Cleveland put his work up for bid. He needed minority participation. I didn’t have any minority ownership in the firm. I didn’t submit a bid . Several black people I know very well approached me, “do you want to the work? I can get you the work.” I said, “I’d like to get the work, but I don’t have a minority component.” So one day I get a phone call from the ex-mayor of Cleveland, TV personality,

Biggest name in the city of Cleveland, if not in the state of Ohio, and they said Mr. Stokes would you like to go to lunch with you. I met Mr. Stokes at a well-known restaurant that since closed, black guy. Very cordial. He said he’d never met me, knew me by reputation. He said, “How would you like to get the city of Cleveland collection work?” I said, “I’d love to but I don’t have the necessary minority component.” he said, “I’d like to be your minority partner.” I said that’s interesting. I said “How do you know that I can get the work if you become my minority partner?” He said the head of city Council, which was another big-name, a national name, owes me a favor, and I’m going to use that favor of mine. I said what’s going to be your minority participation in our entity that’s going to get the city clean work he said I’ll come by every Friday and pick up my check, so I said Mr. Mayor in all due respect if George owes you a favor, we’re going to be collecting money from poor inner-city people that can’t pay their utilities. We’re going to be collecting money from people that got parking tickets in the city of Cleveland and rammed their cars into water poles and things like that. I said Mr. Mayor if George owes you a favor, this will not be a very lucrative for you. I’d use the favor for something else. I was twenty-something years old. That’s the only time I’ve ever been approached, and the reason, and when I tell that story and people say because well you don’t present yourself in a way that would open it up for someone to make that invitation. It’s a simple as that.

I ended, “I know other debt brokers that do exactly that. They’ve bought their way in.”

Leave a Reply

You must be logged in to post a comment.