Compliance

-

Happy Labor Day | Are You Ready To Reduce Your Labor Costs While Getting Better Staff?

- September 2, 2018

- Posted by: Phillip W. Duff

- Categories: Compliance, International, Jamaica, Latest Post, Nearshore call Centers, Reduce labor cost, Training

No Comments

-

How My Clients Bridge the Strategy-Execution Gap

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Latest Post, Law Firms, Opinions, Technology, Training

-

Is Your Company Really Set Up to Support Your Collection Strategies?

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Latest Post, Law Firms, Opinions, Security, Technology, Training

-

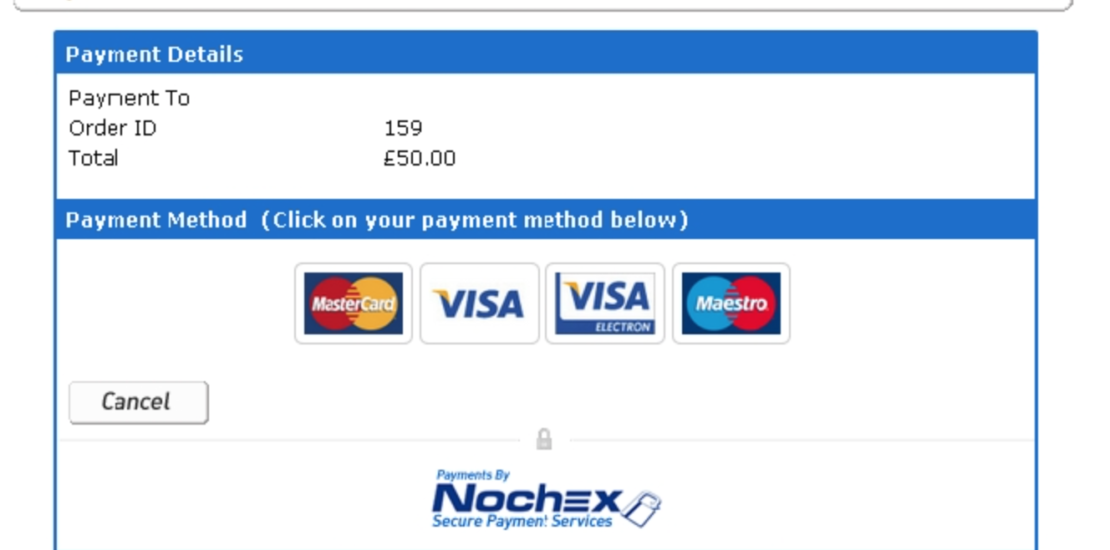

I Can Tell If Your Payment Website Is Effective By The First Page

- December 4, 2017

- Posted by: Phillip W. Duff

- Categories: Compliance, Finance & accounting, Law Firms, Opinions, Regulations, Technology, Training, Uncategorized

-

Three Top Trends In Debt Collection Contacts

- July 30, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Jamaica, Opinions, Training

-

It’s Good To Be Crazy, It Opens Up So Many More Options

- July 24, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Latest Post, Law Firms, Opinions, Technology, Uncategorized

-

Silence Is Golden And Duct Tape Is Silver

- June 15, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Latest Post, Opinions, Training

-

My Thoughts From The NARCA Conference

- May 23, 2017

- Posted by: Phillip W. Duff

- Categories: Compliance, Latest Post, Law Firms, Opinions, Technology

-

Naked Is The Best Disguise For The Collection Industry

- April 22, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Interviews, Latest Post, Opinions, Security

-

Self pay healthcare accounts should be self pay collection accounts. Your how to guide to self cure.

- April 22, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Latest Post, Opinions, Technology

how can we help you?

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.

see our gallery