2017 May

-

It’s not how you skin the rabbit, it’s how the rabbits fur grows back.

- May 24, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Latest Post, Opinions, Technology, Training, Uncategorized

No Comments

-

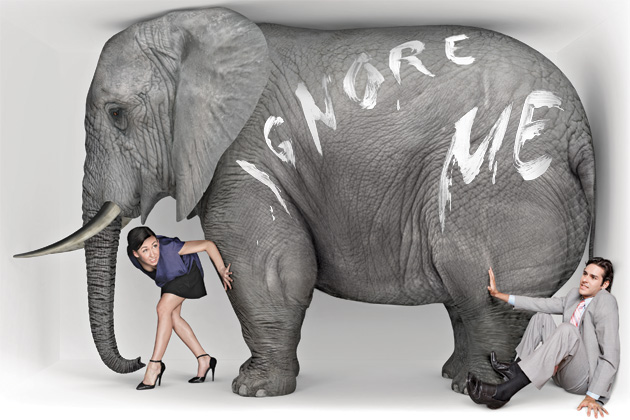

If there is an elephant in the room, I brought it

- May 24, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Opinions, Technology, Training

-

My Thoughts From The NARCA Conference

- May 23, 2017

- Posted by: Phillip W. Duff

- Categories: Compliance, Latest Post, Law Firms, Opinions, Technology

-

Lighthouse Consulting Goes International

- May 19, 2017

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Latest Post, Marketing, Opinions, Uncategorized

how can we help you?

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.

see our gallery