2016 August

-

Jamacian Call Center News

- August 23, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Compliance, Interviews, Law Firms, Marketing, Opinions, Regulations, Technology, Uncategorized

No Comments

-

“¡Me pica qué, me rasca aquí! Translated “It itches me here, but you are scratching me there.”

- August 9, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Interviews, Law Firms, Marketing, Opinions, Security, Technology, Training

-

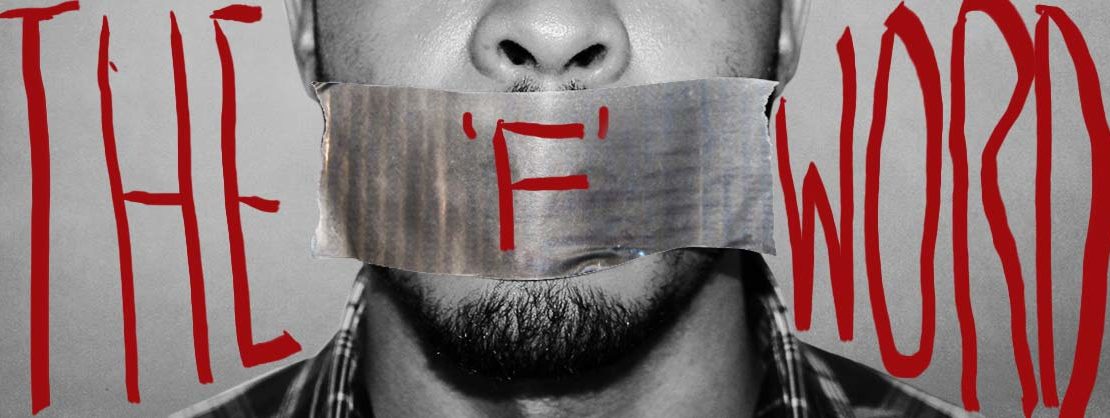

Do Not Utter The “F” Word

- August 9, 2016

- Posted by: Phillip W. Duff

- Categories: Agencies, Buyers, Compliance, Latest Post, Opinions, Training

how can we help you?

Contact us at the Consulting WP office nearest to you or submit a business inquiry online.

see our gallery